August 8, 2018

Are you hoping that by the time you are ready to retire and cash in on your investments the market will be at a higher place? This is considered a “Buy and Hope” investor, otherwise known as a passive investor. Utilizing this method of investing has the potential to leave you vulnerable to a number of market risks.

In this episode of Money Script Monday, Rob presents the advantages of implementing a more hands-on, tactical approach to your investment strategy.

Video Transcription

Hi. My name is Robert Reaburn. And today we’re going to be talking about an alternative approach to investing called tactical investing.

Now, more traditionally speaking, a lot of clients are involved in what we call Buy and Hope investing, otherwise known as passive investing.

The reason why we call it Buy and Hope investing is that most investors that are in a passive investment strategy are really hoping that by the time they are ready to cash in on their investments that the market is at a higher place.

Well, hoping is great. It’s not really a strategy.

For clients that want a more hands-on approach, a more tailored approach, that meets their actual investment needs, a tactical investment approach may make sense for you.

To understand when a tactical investment approach might make sense, it’s really important for us to distinguish:

What is a passive investment strategy?

What is a tactical investing strategy?

When does it make sense to use one over the other?

Today, we’re going to go over the advantages and disadvantages of both investment strategies and then, just as important, go over the structure and the pricing of these products to really help you understand not only what you’re getting, but really what you’re paying for.

Danger of Bonds

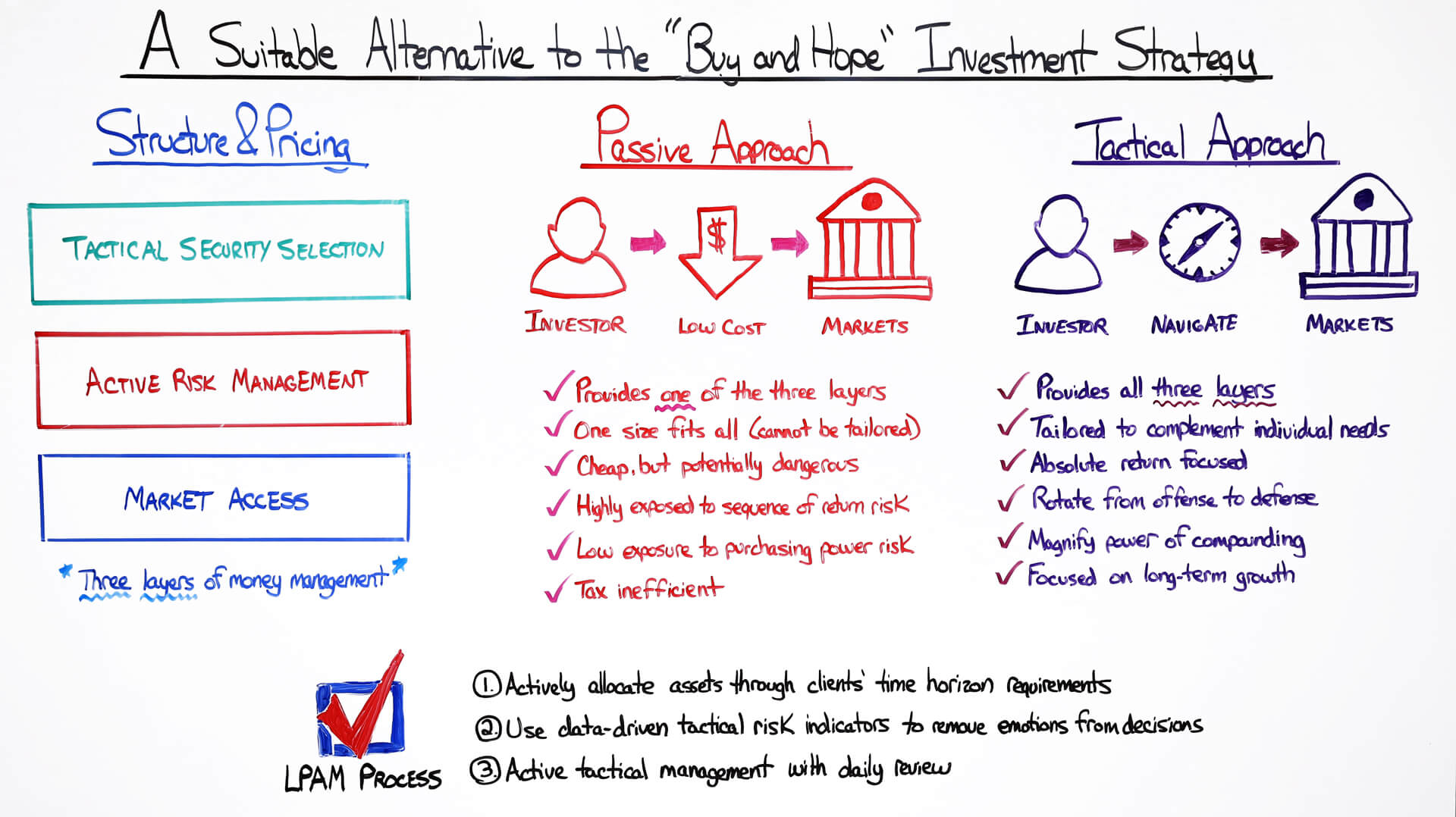

The first thing we’re going to review today is the structure and the pricing of investment products.

When we look at the pricing of investment products today, there’s really three layers that contribute to pricing:

- Market access

- Active risk management

- Tactical security selection

The more layers we incorporate into the money management process, the higher the management fee is going to be.

For example, for clients that simply want access to the market, such as the S&P 500 or any other commonly-known investment benchmarks, whether it’s a growth benchmark or a value benchmark, are going to simply get market access and a lower price.

In other words, they’re going to access the market. And there’s going to be no additional management of that money.

Now, we do get some clients that say, “Well, it’s great that I have access to the market, but I don’t know when I should be reducing my risk to the market and when I should be actually utilizing downward dips in the market to increase my exposure.”

That’s where active risk management comes into play.

When you add this second layer of money management services to your investment strategy, what you get is a third party that comes into your portfolio, into your account, and says,

“When does it make sense to quite simply be in the market and when does it make sense to not be as exposed to the market?”

In other words, raise those cash levels.

Now, those clients might say, “Hey, this is awesome. I have access to the market and someone is managing my risk, but at the same time, I want to be a little bit more specific as to where I’m investing my money.”

“In other words, I don’t want to just buy the entire market, the good and the bad, but I want to target the specific areas of the market that are going to do better than the other areas of the market.”

That’s where tactical security selection comes into play.

This third layer of money management looks at the S&P 500 or any other market that’s available to investors and says,

“What are the sectors within the market that are most advantageously positioned to take advantage of certain growth trends that are taking place in the market?”

“And what are the companies within those sectors that are leading positive disruptive change?”

You can see, depending on how many layers of money management you want to incorporate into your overall investment strategy, it’s going to either contribute to more management fees or it’s going to keep you at a very low level of overall fee exposure.

It all depends on what you’re looking for as the client.

So, what is the difference between passive investing and tactical investing? And when does it make sense for you?

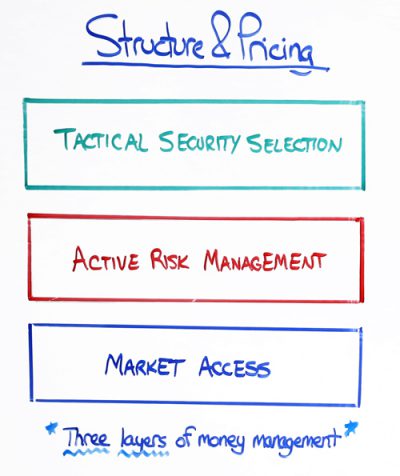

Passive Approach

A passive investment approach really involves that first layer of money management. In other words, that market access piece.

When you buy a Vanguard product, it’s a great product. In many cases, we recommend it to clients, but what it provides is quite simply market access at a very, very cheap price.

If the portfolio manager of that Vanguard product suspects that the market is about to enter into a new bear market cycle, in other words, a sustained draw-down in the market of 30% or 40%, it doesn’t matter.

He or she will not do anything to reduce risk in your portfolio.

That is not the job of these market access products. It will keep you invested unless you, the client, determine that you want to sell and reduce that exposure.

That is what you get with a passive investment approach.

What we say is that passive investing is cheap, but it’s also potentially dangerous, if you need that money in the short term.

It exposes you to what we call sequence of return risk.

That’s really the chief weakness behind passive investing.

One of the strengths behind passive investing is it addresses the other big risks that we as investors face, which is inflation or in other words, purchasing power risk.

Because passive investing has a long-term outlook, a lot of the times, it can keep pace with the market or and oftentimes actually beat a certain aspects of the market over time, which is positive for keeping ahead of inflation.

The last thing we’ll say is that passive investing is also quite tax inefficient because you are invested in a mutual fund.

This involves active mutual funds or passive mutual funds, but that mutual funds structure or ETS structure punishes you, the investor, for the actions of others.

In other words, capital gains that are triggered by other investors that are buying and selling that ETF causes capital gains to be passed along down to each individual unit holder.

That’s something we really want to try and minimize for our investors.

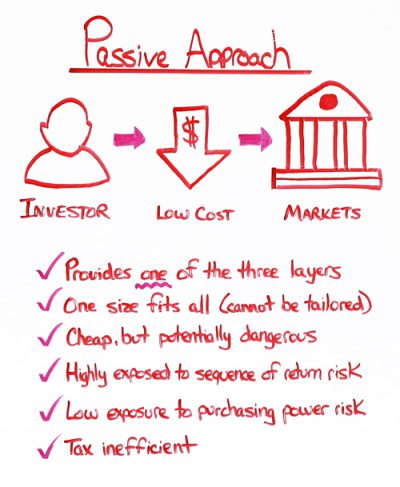

Tactical Approach

Now, when does it make sense to have taken a more tactical approach to investing?

Our specific investing strategies at LifePro Asset Management, are all tactical in nature.

In other words, when we invest our client’s money, we want to take an approach that is 100% tactical, tailored, and transparent.

What does that mean? That means we provide all three layers of money management.

We provide access to the market, we provide active risk management. In other words, every single morning, we come into the office and based on our risk indicators, we say, “Do we even want to own stocks?”

If the answer is no, then we don’t even bother with the security selection process because it doesn’t matter how good of a stock picker you are. If the market is going to go down, you’re going to lose money.

If the answer is yes, then we move onto that third layer of money management called tactical securities selection.

We’re going to look at the specific sectors within the market that we like, based on our fundamental analysis and then look for those company leaders that are leading positive disruptive change.

A great example over the last couple of months is Facebook.

Facebook has been one of our favorite companies for many years, but in May and June, a lot of our indicators started to suggest that ad revenue was beginning to slow down.

So, what we did was we sold Facebook to zero across all of our client portfolios while remaining invested in the market because our indicators were positive on the market, but negative on this specific company.

You can see how that would have played out in the month of July, which is one of the reasons why we’re able to outperform over the last few months.

The other advantage of a tactical investment strategy is that it allows us to quickly rotate from offense to defense.

In other words, if we are investing all of your money in the market and we turn more cautious in the market, every investment that we have is 100% liquid and can be transitioned to cash extremely quickly with under five minutes per that client portfolio.

That really gives you a sense of the more tailored approach, the more hands-on approach, a tactical investment strategy can offer clients.

We always say that a tactical investment strategy cannot promise to limit downside risk.

But it does offer the tools that, if we see the train coming, if our indicators work and identify a train is about to hit us, we can get out of the way.

A passive investment strategy can see the train coming, but it will still voluntary get hit by that train because that’s not the mandate of that strategy.

It’s not the job of a Vanguard to get you out of the way. It’s your job to get you out of the way.

Our job is to tap you on the shoulder and let you know, “Hey, by the way, we went ahead and de-risked that portfolio for you.”

LifePro Asset Management Process

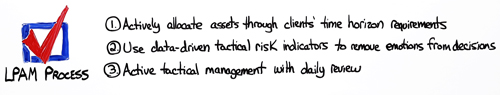

To sum up, the way we look at asset allocation and investment management is that we want to actively allocate client assets throughout their entire investment experience.

Our tactical investment approach is not limited simply to portfolio construction, but it also extends to the overall asset allocation experience.

Our advisors who are affiliated with LifePro Asset Management are really your financial quarterback.

They determine when you need to have assets that are more growth-oriented and when you need to transition those more growth-oriented investments to a more conservative type of investment product that we also offer here at LifePro.

The closer we get to consumption of cash is when we want to increase the level of conservative investments in your overall portfolio.

All of our tactical risk indicators are completely data-driven. In other words, we remove emotion from the overall investment process.

These are indicators that we’ve tried and tested from 2008, 2011, 2012, and 2015 through various periods of highly volatile markets.

They’re indicators that we constantly are improving and stress testing.

Contact LifePro Asset Management

If that type of approach makes sense to you and it really sounds more attractive than say your more traditional, plain, vanilla, passive investment approach, we are definitely here to help and continue that conversation and really determine if this is the right fit for you, the client.

Thank you for your time. And as usual, if you have any questions or concerns, please feel free to contact us here at LifePro Asset Management at 1-888-LIFEPRO. We will be most certainly glad to help. Thank you and have a wonderful day.