February 4, 2019

Even bull markets can have periods of heightened volatility and create uncertainty for both investors and clients. In this episode of Money Script Monday, Robert explains LifePro Asset Management’s 3-step process to strengthen your investment strategy in times of stock market uncertainty.

In this episode of Money Script Monday, Rob offers a deep inside look into the LifePro Asset Management stock selection process and shows you how they craft portfolios that help deliver value to clients.

Video Transcription

Welcome to another episode of Money Script Monday.

My name is Robert Reaburn, and today we’re going to be going over how to effectively navigate a stock market correction.

As we saw back in the month of December and earlier in 2018, even a bull market can have periods of heightened volatility and create huge uncertainty for clients and investors alike.

That’s why it’s so important to have a process that all of us can rely on when these periods of uncertainty arise.

Clients often ask me, “What is the first thing that I can do to help fortify my investment plan and also how to plan for these periods of uncertainty?”

The number one step that I believe clients should take is by teaming up with a financial advisor, and that’s because the results speak for themselves.

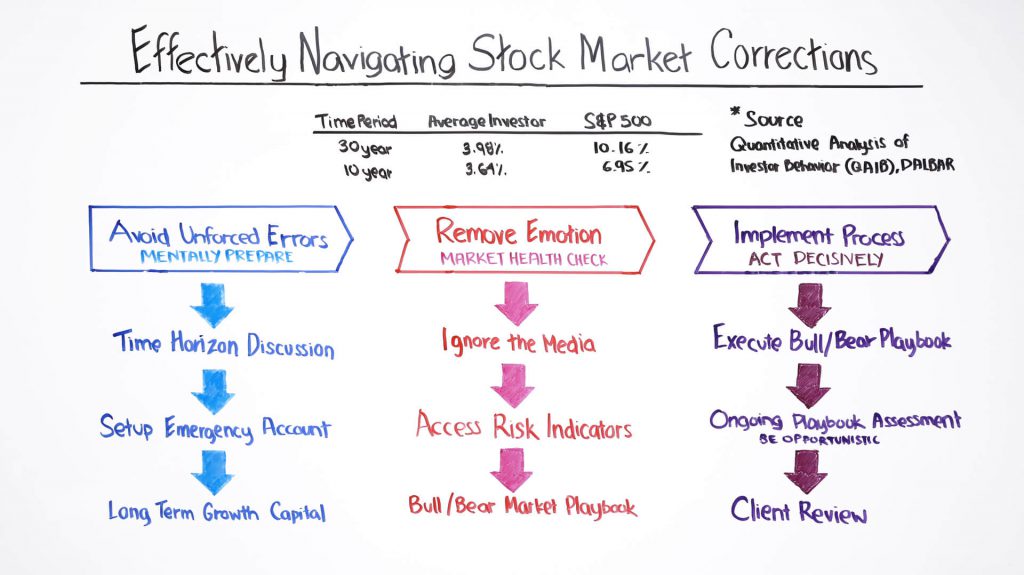

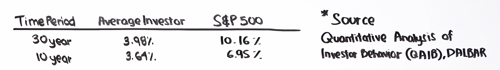

When we look at the average S&P 500 return over a 10 and 30 year period from an annualized perspective, we see returns anywhere from 7.5% to 10%, yet the average investor is only realizing around 3.5%.

What is creating this huge disparity between market returns and realized returns by investors?

That comes down to behavior.

A lot of times we’re taking great first steps by putting our money into the market, having a long term approach, but then when we get periods of volatility, we get scared.

That’s where a swing coach, in other words, where a financial advisor acts as our swing coach can come in handy and help guide us through these periods of volatility.

In other words, a lot of times it’s great just to have a person to say, “Hey, you know, what? I see what’s going on in your portfolio. I just want to let you know, this is typically temporary in nature and here’s how we’re going to approach it. And here are the steps we’re going to take next.”

That’s why financial advisors tend to be accretive for investor returns versus a client that doesn’t have a financial advisor.

Now, once you are teamed up with a financial advisor, the next step we want to do is make sure that we actually have an investment process that we can implement.

Both at the financial planning level, and then at the portfolio construction level that helps us deal with these stock market corrections in a way that actually when we exit the stock market correction, we’re better prepared, and the portfolio is better positioned for the recovery.

What we did here, at LifePro Asset Management, is we created a three-step process to help clients use stock market corrections as moments of opportunity versus as moments of fear.

These three steps are constructing a financial plan that can deal with both stock market corrections and periods of expansion in the market.

Making sure that we design an investment process that removes emotion from the decision-making process.

Finally, when we do have to implement that process that we can implement it quickly and act decisively when the moment arrives.

Avoid Unforced Errors

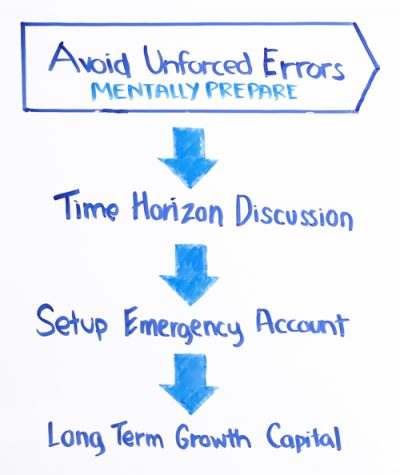

The first step is really talking about how do we avoid those unforced errors?

In other words, when the stock market has a quick but dramatic correction in the market, avoiding selling low and then buying higher.

That process starts with building a financial plan that can help you remove that emotion.

When we think of financial planning, a lot of the times most advisors will talk about risk tolerances.

The problem with risk tolerance surveys is that when the markets are doing well, we tend to overestimate our ability to take risks, and when markets sell off, we have a tendency to underestimate our ability to utilize risk to our advantage.

What we did is we created more of a time horizon focused planning approach.

What this really means is we divide risk into two segments.

What we call sequence-of-return risk. In other words, that risk that you experienced an unrealized loss and have to convert that to a realized loss because you need the money in the short term and the longer-term risk of inflation.

In the short term, what we want to do is to help you minimize that sequence-of-return risks.

What we’ve done is we created a time horizon process that divides your money between short term money that you need and long-term money that can help target growth over the long term.

The first step we do is we walk through with you your investible assets and get an estimation as to how much money are you planning on using over the next, say, zero to three years and how much money can you leave in the market for four years and beyond.

That’s a really critical piece of information because if we know that, let’s say of the $500,000 of investible assets that your household has, that we can leave $300,000 with a time period of 5 years and beyond.

We know that we can take a more targeted growth approach and have more flexibility when the markets go through periods of heightened volatility.

The reason for that is we know on average, even in a 2008 type of scenario, the time to recovery to get back your principle is about 4.2 years.

In other words, we’re eliminating that sequence of return risk.

The second step is setting up an emergency account. I just think this is very critical for any household, regardless of the size of your investible assets.

We always want to make sure that you have a safe liquid pool of cash that you can rely on.

If, knock on wood, something happens in your household that requires quick funding, or if you just want to go on vacation or buy that new car.

In other words, we don’t want that kind of money exposed to the day to day moves in the market. That’s what we call sequence-of-return risk.

Finally, when we’ve set up that short-term bucket of money and your emergency account, we take the remainder of your assets and we say “This is your longterm capital.”

In other words, we take that money and we target it with growth because growth is the best way to attack the risk of inflation.

Remove Emotion

The second step in the planning process comes with implementing a tactical investment approach.

This starts with removing emotion from the investment process.

This is by far the biggest mistake that both professional investors and retail investors make. They see prices come down and that means there’s something bad going on.

What we do here at LifePro is we’ve created, and tested, over many years, an investment process that focuses on data.

At the end of the day, the market over the short term is what we call a voting machine.

In other words, buyers and sellers that are pushing the market one way or the other, but in the long term, it is a weighing machine.

In other words, it ways the value of how companies are doing and over the long run, those prices reflect the underlying fundamentals.

The way we navigate the stock market is we look at a series of risk indicators that say:

- How’s the economy doing?

- What is investor sentiment right now?

- How are stocks currently being valued?

The one correlation we’ll find across all bear markets is that stocks were overpriced when the bear market correction began.

We want to make sure that we can buy high-quality, long term secular growth companies at reasonable prices that reflect their value and give us upside versus other asset classes such as bonds and real estate.

Lastly, we want to make sure once we understand what our indicators are telling us.

For example, if we look at the prior correction that occurred this past December, we say:

“Well, our indicators are actually telling us that the fundamentals are improving, corporate earnings continue to grow and in many cases are accelerating, and investor sentiment is poor.”

When we see that dislocation, we pull out our bull market playbook.

Based on that, whether we’re pulling the bull market playbook or the bear market playbook, it helps guide our next step.

In other words, we’re paying attention to the data. We’re not worried about what the media is saying, we’re not worried about what Jim Cramer is saying, and we’re not worried about what our neighbors saying.

We’re just paying attention to the numbers.

Implement Process

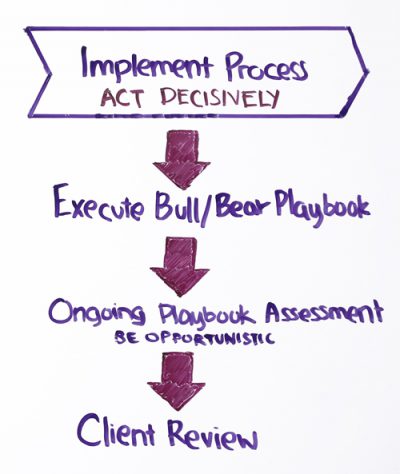

The last step is implementing the process.

Many people, many investors, many friends and family, we always have a process that we read about that we have an intention of following, but when it comes down to implementing it, that’s when we kind of sway off that road.

That’s where an advisor comes in handy.

The advisor can help you make sure you stick to the process and implement it when we really need to. In other words, we act decisively.

Once we’ve determined whether we’re going to go with a bull market playbook or that bear market playbook, we execute it.

Let’s take the prior correction that occurred this past December. What we noticed was that jobless claims were falling into multi decade lows.

In other words, less people were filing for unemployment, we noticed that industrial production was expanding, and we noticed that the actual management comments from the individual companies that we invest in were very, very bullish, yet stock prices were coming down.

What happens there is we pull out that bull market playbook, we talk to clients about what’s happening in the market and what we’re going to do next.

What we’re going to do next is we’re going to buy these highly valuable companies that were like 20% higher but are now available at a 20% discount.

In other words, when we’re in a bull market environment, we kind of look at that as almost like a black Friday sale.

All of these companies are suddenly going on sale. That’s a huge opportunity for our clients to realize forward returns, if our indicators are correct, by buying these great companies at discounted prices.

Once we do that, we want to make sure that we’re assessing that playbook and making sure, “Hey, if there’s anything that we didn’t do right during that process, how can we do it differently?”

That’s where we talk to the clients, we let them know what we did right, what we did wrong, and how we can improve that going forward.

Because the one thing about investing is there’s no perfect path, and it’s all about testing and it’s all about that one on one engagement between us, the advisor, and our clients.

Then making sure that clients are comfortable with what we’re doing. And that’s where that portfolio review is so important.

Even if we’re right or wrong, we want to make sure we’re reviewing it and that where you are in your life, it still makes sense to have the asset allocation framework that we’ve designed for you remain in place or if we need to make those adjustments.

By having these three steps that we can follow, both in the investment planning process, teaming up with that financial advisor and then implementing an investment process that removes emotion.

We can really start to approach bull market corrections and other corrections the way we should.

In other words, as prices are falling, and many times we want to approach that opportunistically and not with fear. And we want to do that with conviction.

That’s how we approach bull market corrections and stock market corrections in general.

If you have any questions in terms of how we implement this and how our investment processes designed, please feel free to give LifePro Asset Management a call at (888)543-3776 and we’ll be more than glad to walk you through it.

Thank you again for your interest and have a wonderful week and a wonderful new year.