As we enter the new year, everyone at the LifePro Asset Management family would like to wish all our clients and advisors a happy, healthy and prosperous 2019. We are grateful and humbled by your continued support and partnership. While December was a painful reminder that even bull markets can deliver painful corrections, our tactical indicators remain green, as recession risk appears low and growth, robust.

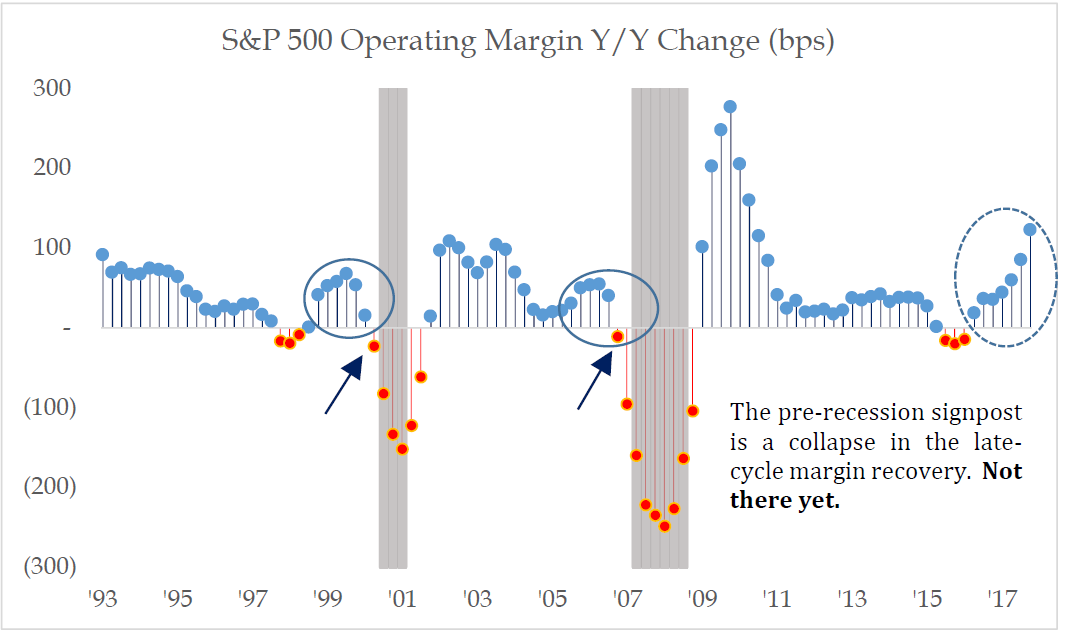

As the stock market selloff accelerated prior to Christmas, public companies were in the process of making more money and becoming more profitable. The chart below illustrates the powerful expansion in operating margins for U.S. companies, which is not symptomatic of an approaching recession. As a result, we used the weakness in December to be opportunistic buyers of stocks, not panicked sellers.

Source: Strategas

As we navigate the continued swings of the marketplace, our job is to not only help, coach and guide you through the market but also to learn from you so that we can make your financial journey, an enjoyable one. We could not be more excited for what’s is in store for 2019, the new tools we plan to unveil for our clients and most importantly, the continued opportunity to engage and learn from our clients, that have all carved their own unique path to success in life.

Investing is a marriage between the suppliers of capital, our clients, and ourselves, the fiduciaries responsible to investing your money in a way that best positions you to meet your goals. Like a marriage, it’s not what you do when times are certain that determine long term success but what you do when uncertainty is elevated and having a process for dispute resolution that positions any marriage, personal or financial for long term prosperity. Having an investment process, that relies on data and removes emotion from the decision-making process is our version of dispute resolution.

Throughout the month of December, the stock market selloff accelerated, taking down the prices of most stocks, regardless of their fundamental prospects. As the selloff intensified, fear was palpable as concerns over recession and trade wars increased. In other words, fear was in control of the market and rationality was removed from the equation. The easy action would have been to sell, sit in cash and enjoy the holidays but it also would have been the wrong decision. We did the opposite, we held the line and then went on offense.

As fears over recession and rising interest rates being reported in the press, were sending the price of stocks lower, our Tactical Indicators were painting an entirely different picture. Throughout the month of December, the data points we follow were pointing to a healthy and accelerating labor market, an expansion in retail consumption, benign inflation and improving corporate fundamentals. While the economic and corporate fundamental backdrop remained healthy and robust, stocks had become 20% cheaper in price. As a result, we held our investments and bought into new investments that were previously too expensive.

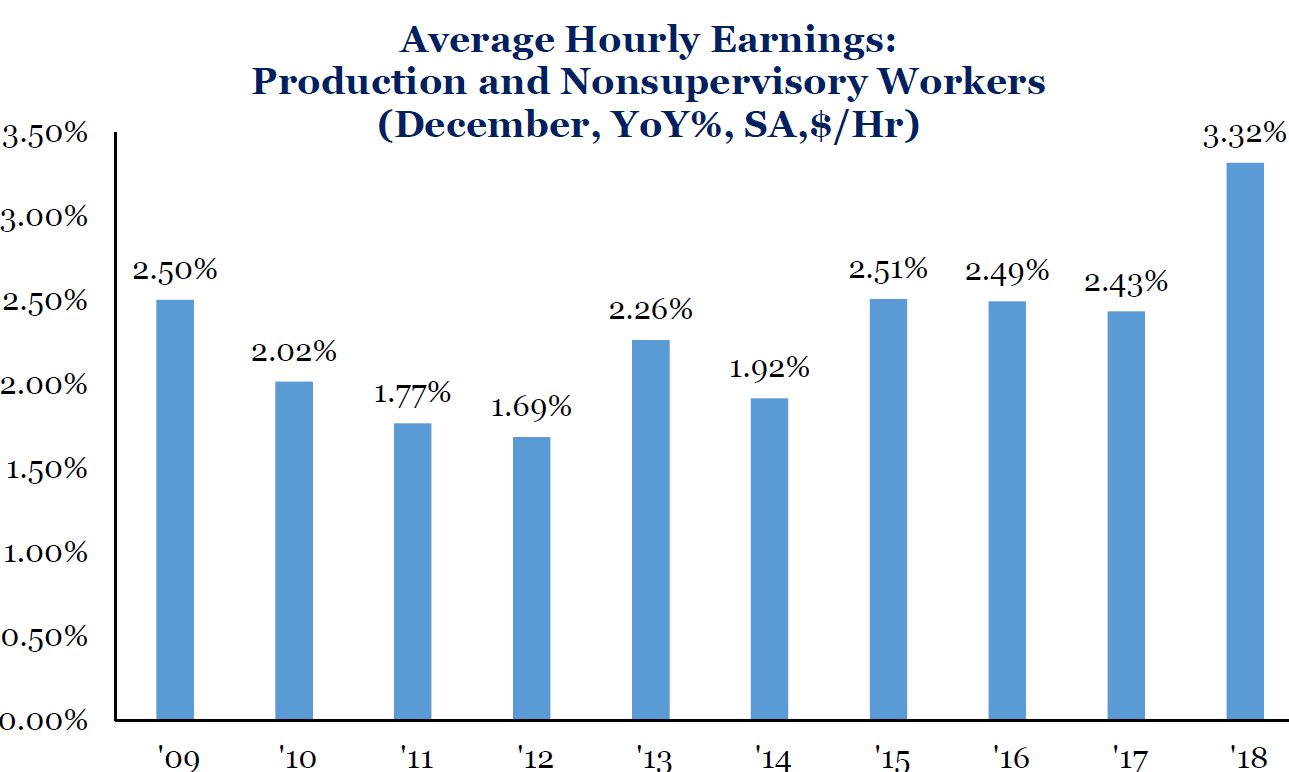

Three weeks forward, we now have evidence that our Tactical Indicators were correct. The U.S. Labor Department reported that the U.S. added 312,000 jobs in the month of December (the most since February 2018), wage growth accelerated to 3.2%, industrial production grew above estimates while inflation has slowed from 2.9% in July to 1.9% in December. Strong wage growth, benign inflation and cheap stock prices are the mother’s milk of bull market rallies.

Source: Strategas

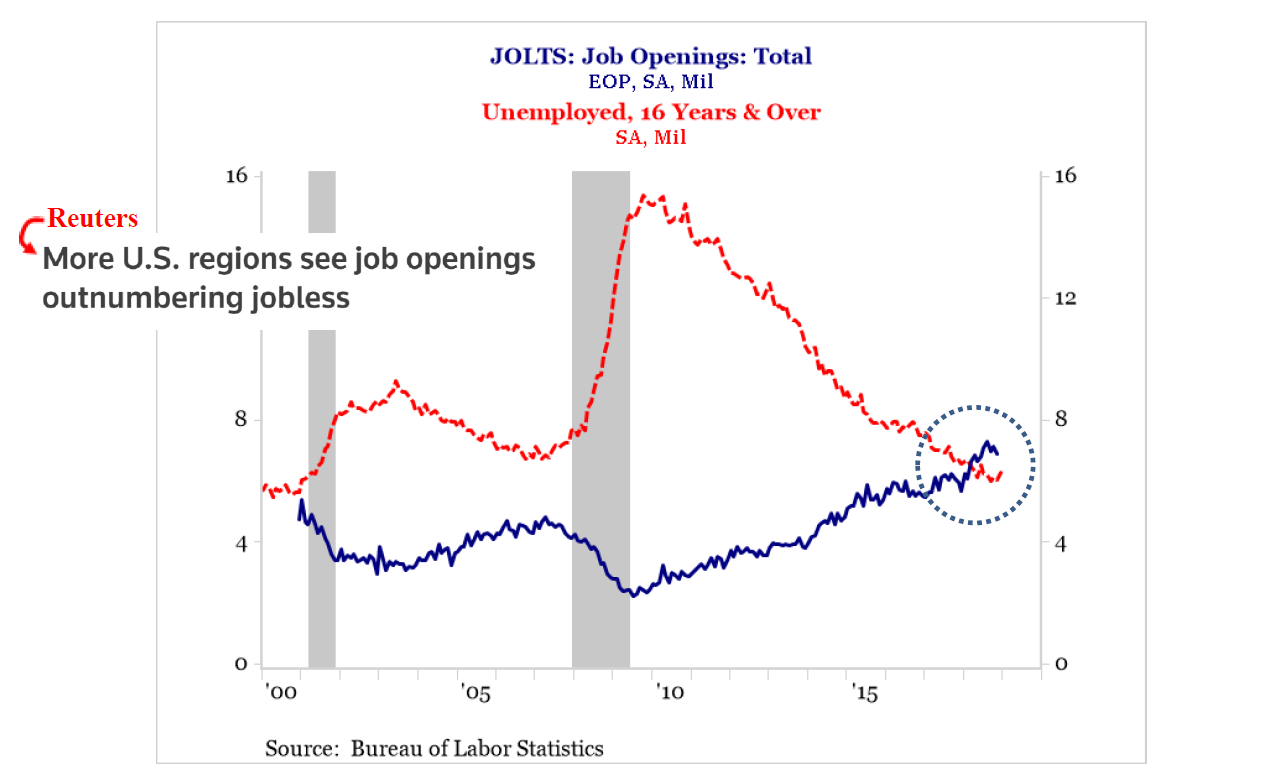

Since December 24th 2018, the S&P 500 has rebounded +13.59% while the LPAM Tactical Opportunity strategy has risen +17.08% over the same three-week time period. The bottom line is that despite the discomfort & uncertainty perpetuated by December’s painful but temporary bout of downward price volatility, recession risk remains low and growth while plateauing, remains stable. In fact, for the first time in over 20 years, the number of job openings across the US outnumbers the amount of jobless people looking for work. The chart below illustrates the dramatic development, which is not recessionary in nature to say the least.

Source: Strategas

The question remains, how do we determine that such environments are good or bad for stocks? As students of history, we go to great lengths to study the nature of previous market cycles and the behavioral symptoms and factors that tend to persist and have an outsized influence on future asset price direction, across various cycles, regardless of the identified cause.

History suggests that factors such as macro-economic growth, inflation, investor sentiment and asset valuation tend to have an outsized influence on the likely path of future asset price direction. Thankfully this fundamentally aligns with our economic work, since wages and growth feed into consumption, inflation determines the path of interest rates while asset prices ultimately determine whether stock prices are attractive or expensive. All these factors come together to give us a reasonable risk vs. return framework.

It’s important to note that bull or bear markets can take shape in several different market environments, but the factors discussed provide a reliable framework to help identify levels of confidence to determine the path of least resistance for future asset prices. The level of reliability and confidence in this framework is based on factor alignment. When all the factors align, confidence is high, and when factor alignment drops, the confidence level decreases.

Source: LifePro Asset Management

As a result, our tactical indicators focus on the inputs that materially affect the direction of each identified factor, gauge the likely path forward for each factor and then study the potential impact on economically sensitive asset prices 6-12 months forward. Based on this work, we then decide whether to increase or decrease client exposure to economically sensitive assets such as stocks and bonds.

Based on our tactical indicators, as the table above references, the current factor mixes appear to be favorable for stocks over a 6-12-month time frame. Importantly, the core factors that historically influence the path of future asset prices are aligned positively right now, which suggests that a higher degree of confidence is warranted.

As a result, despite the panic in the market and the 24/7 media fear cycle, we stayed disciplined, patient and used our tactical indicators to guide our next steps. With the broad indicators in positive alignment, we used the selloff in December to purchase stocks we have liked for a long time but were otherwise too expensive. Exiting the year, we increased client exposure to technology and consumer discretionary stocks while slightly reducing our weight in industrial stocks.

Regardless of what our indicators say, the stock market is never a straight path upward. In fact, recoveries off the bottom of bull market corrections are marked by a series of higher lows as the market climbs the wall of worry. What this means is that despite our positive stance on the stock market, it would not be a surprise and in fact an expectation of ours that we will get a couple of aftershocks post the Christmas Eve low of December 24th.

The important thing to remember is that unless the factors which drive the long-term path of asset prices change, we want to navigate temporary moments of market weakness opportunistically by searching for high quality growth companies that have been discarded and that are now available at deeply discounted prices relative to their intrinsic value.

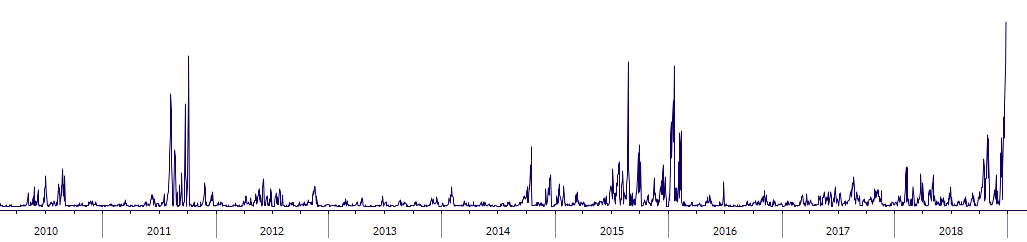

% of Stocks at 52 Week Lows

The one characteristic that most successful investors share is that they tend to be greedy when others are fearful and fearful when others are greedy. The chart above illustrates how extreme fear can force investors to discard coveted diamonds right before the market resumes it march upward. The lesson is that we want to hold on tightly to our diamonds while keeping an opportunistic eye for diamonds discarded by the fearful.

From everyone at the LifePro Asset Management family, Happy New Years and thank you for your business and continued loyalty. We are truly grateful to be partners with such a disciplined group of advisors and clients, whose support and friendship makes our jobs fun and rewarding. As always, if you have any questions on your specific portfolio, the market or any question in general please do not hesitate to reach out to our team and we will be more than happy to have a conversation with you. Thank you again and have a fantastic New Years.

The information presented here is not specific to any individual’s personal circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Investments involve risk and are not guaranteed. Actual performance of client portfolios may differ slightly due to various factors such as client deposits or withdrawals, investment guidelines and restrictions, or fees and expenses incurred by any specific individual portfolio, among other factors. S&P 500 is an unmanaged index of the shares of 500 widely held, predominantly large capitalization, U.S. exchange-listed common stocks. The index results neither include dividends reinvested nor reflect fees and expenses. Investors cannot invest in any index directly.

The discussion of any positions and/or recommendations discussed herein should not be assumed as an indication of future results. Due to various factors, including changing market conditions, such discussion may no longer be reflective of current position(s) and/or recommendation(s). Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or equal any historical performance.