How a strong market combined with extreme pessimism is creating a potential tax burden for many passive mutual fund investors

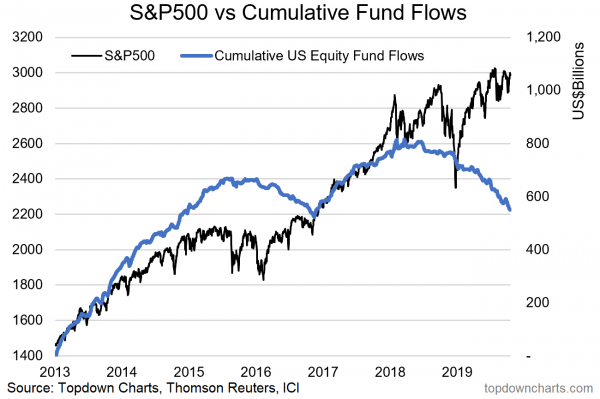

Despite record highs in the stock market, investor sentiment remains pessimistic. As a result, equity investment products have experienced record fund outflows as investors seek the safety of bonds with little to no income thanks to record low interest rates.

For disciplined investors which remained invested in passive equity funds, the combination of large year-to-date gains and record equity outflows means mutual fund investors will likely experience substantial capital gains tax on distributions in 2019.

Increased equity outflows are increasing mutual fund redemptions despite large gains YTD.

Redemptions occur as investors sell their units (shares) of a mutual fund. When this occurs, the fund is required to sell investment positions to pay out the redeeming investor. When the investment fund is forced to sell existing investments, the mutual fund realizes capital gains, which results in a taxable event for the remaining unit holders (you). As a result, tax distributions are passed down to existing unit holders.

To illustrate the impact of capital gain distributions, let’s look at an example.

The mutual fund investor below owns 1,000 shares of ABC fund at a share price (NAV) of $10. At the end of the year ABC fund will distribute $1 of gains per share to its shareholders. If this distribution is reinvested, the investor will now own 1,111.11 shares of ABC fund at $9.

In both scenarios the investor’s investment in ABC fund is worth $10,000. So, what’s the difference? If the investor owns ABC fund in a taxable account, the investor will be responsible for $1,000 in capital gains from this event.

With year-end distributions on the horizon, many mutual fund companies are posting their expected capital gain distributions. It’s strongly advised that investors reference the mutual fund website to keep an eye out for unexpected tax bills.

In some cases, it may make sense for investors to consider a change in direction ahead of the distribution date if they are unhappy with the performance of their product. Making changes ahead of the distribution date can help investors avoid an unwanted tax bill for a product that has not delivered the expected value clients were expecting.

For investors trying to manage the tax implications of their investments, a separately managed account (SMA) investment structure, may offer a more tax efficient investment experience. An SMA is an investment structure where the professional investment strategy is implemented at the client account level, resulting in direct client ownership of stocks and bonds. When an investor directly owns a stock or bond at the account level, taxable events are only triggered by client actions, not the actions of others.

As year-end distributions quickly approach, this is a great opportunity to review your current financial plan. At LifePro Asset Management, we work with financial advisors and their clients on developing investment solutions which are not impacted by the actions of others. Due to each person’s unique situation, please contact our financial design team to find out how our unique investment solutions may be a fit for you and your clients.

Investment advisory services offered through LifePro Asset Management, LLC, a registered investment adviser. The information presented here is not specific to any individual’s personal circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstance. Investments involve risk and are not guaranteed. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Advisor), will be profitable or replicate its previous historical performance. S&P 500 is an unmanaged index of the shares of 500 widely held, predominantly large capitalization, U.S. exchange-listed common stocks. The index results neither include dividends reinvested nor reflect fees and expenses. Investors cannot invest in any index directly.