On this day in 2019 the WHO first identified a viral pneumonia out of China that would come to be known as COVID-19. At the time, the story was a but mere footnote in the back pages of medical journals but would soon ripple through the world, altering the path of history and impacting the lives of billions around the planet for years to come.

The lesson from COVID is that time and history can move slowly then all at once, sweeping aside the existing structures and implementing a new regime that instill new rules, patterns, and structures that we must all adapt to or risk being swept away by the tides of history.

Early on in COVID, we took a decidedly risk on approach to markets as we anticipated a massive monetary and fiscal response to the pandemic, which would ultimately be positive for risk assets and an accelerant for secular growth stocks. For this our investors were rewarded.

In year 2, we got it wrong, not realizing that inflation would be as persistent as it was or serve as the exact opposite accelerant, forcing central banks to increase interest rates at the fastest pace in history and thereby, crushing the valuations of many favored growth stocks. How and why did we miss this?

In 2021, we identified a possible technology and growth stock peak, which led us to shift out of growth and into value sectors such as Energy, in May of 2021. In other words, we nailed the top until we didn’t…

The continued endurance of the growth trade caused us to question whether our process had led us astray. As a result, we reallocated back to technology and reduced energy exposure. It turned out that our process was correct, and our emotion or self doubt was incorrect. Inflation accelerated, central banks responded with massive interest rate cuts, while draining money supply. This served to crush growth stocks and cause a rotation into cheap value stocks.

Many money managers will offer excuses for bad performance and stress patience, believing that yesterdays leaders will eventually rebound back to prior form. Unfortunately, history suggests that such leadership transitions are measured in years and rarely if ever, do prior leaders resume the mantle of leadership of periods of deep retrenchment. If that remains the case today, where will the trillions of investment dollars flowing out of technology, flow into? The current bear market may offer us some clues.

Bear markets come and go but most act with a similar rhythm and rhyme, offering clues about what the recovery may look like and what areas may lead or lag. These clues can appear in different ways and forms, but price action is one of our favourites, as it paints a simple picture of what people are doing with their money and we believe that actions speak louder than words.

When identifying areas of potential future leadership during bear markets, we look for areas that bottom ahead of the overall market and exhibit persistent relative strength vs. the broader market. With technology, communication and other growth stocks seemingly establishing new lows daily, and dominating the headlines, most investors are unaware that under the surface, certain parts of the market, are trying to break out to new highs, defying the logic of a doomsday recession that now dominates the current Wall Street psyche.

Entering the first week of 2023, areas such as energy, gold, industrials, base metals, and stocks related to China are breaking out to new highs. Apart from gold, these areas are early cycle, dependent on economic success, cheap, structurally under owned and maligned across Wall Street and most importantly, are the beneficiaries of rising earnings.

We believe these factors are forming critical elements, along with price, that can help us identify groups of stocks that are prime candidates to lead the stock market during the recovery.

Bottom line: Do current features of the market listed below, represent a stock market worried about recession or a market going through a generational shift in leadership?

What We Think the Market Is Trying to Tell Us

- Industrial stocks close to 52-week highs

- Steel & Iron Ore Stocks breaking out and exhibiting relative strength leadership

- Copper breaking out

- Oil stocks near multi year highs

- China stocks breaking out to multi month highs

- Iron Ore continues to rise in price

- Safe havens such as the U.S. dollar breaking down despite rising interest rates

- Value outperforming growth

- High valuation stocks leading the move to the downside

Our belief, based on what the market is trying to tell us through the investor flow of funds, valuation, technical, earnings and factor leadership in various quant baskets is that the stock market is going through a deep, structural shift in long term leadership, away from growth at any price and toward cheaper hard assets that make things or are inputs into finished products.

Market Share Shift

Source: LifePro Asset Management, LLC. The S&P 500 Price Index is an unmanaged index of 500 widely held, predominantly large capitalization, U.S. exchange-listed common stocks. Indices are not typically available for direct investment, do not include reinvested dividends, are unmanaged, and do not incur fees or expenses.

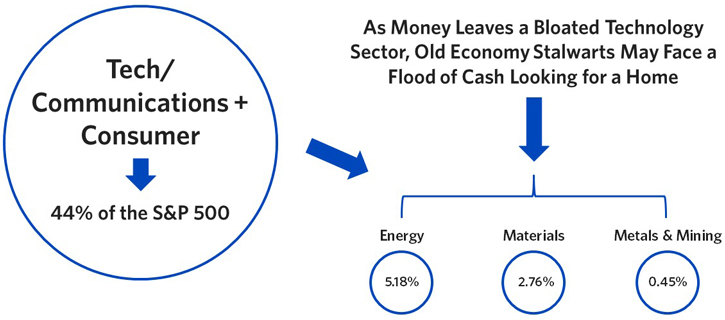

As institutional money, which must remain invested in stocks, begins a reallocation process away from technology led growth and toward industrial fueled growth, we believe the massive 44% of money allocated into technology and consumer stocks will overwhelm much smaller sectors such as materials and industrials, sending those stocks higher. We think this move will be counted in years.

As a result, our portfolios have completed a long, albeit messy transition out of last decades growth technology led growth stocks and into what we are calling the 20’s Growth Basket led by Materials, Energy, Mining, Industrials. Homebuilders and Gold. Unlike last year, we plan to trust but verify and test our process to ensure we exit this bear market as better investors, focused on delivering long term value to your clients.

Investment advisory services offered through LifePro Asset Management, LLC, a SEC registered investment adviser. Registration does not imply a certain level of skill or training. Investments involve risk and are not guaranteed. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Advisor), will be profitable or replicate its previous historical performance. This information is for educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. As such, the information in these materials may change at any time and without notice. Information presented herein is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies.